biyou-kenkomatome.site

Community

Volume Based Indicators

Volume-based indicators in stocks offer valuable insights into market activity by analyzing trading volume. These indicators help you assess the strength of. The Volume ROC indicator compares the most current bar's volume to the volume of a bar in the past (default is 14 bars ago). Volume points to the amount of a financial instrument that was traded over a specified period of time. It can refer to shares, contracts or lots. Trading volume is an indicator least likely to be manipulated by major funds and can reflect true capital flows. Combining volume with price to analyze their. SBV Flow is volume/price based technical indicator which is advanced and improved version of SBV Oscillator (Selling/Buying Volume Oscillator). We still. The Volume Flow Indicator is also used for spotting divergence; divergence in volume might signify trend reversal. Trend might be losing momentum when the. The Volume Relative Strength Index (RSI) refers to a volume indicator that helps in depicting the changes in price through changes in volume. Traders use volume. As a 5 minute scalper of the ES, I have yet to find a volume based indicator that truly clicks for me. I've tried using deviations, using VWAP. The Volume Indicator is a basic yet vital tool in technical analysis, displaying the number of shares or contracts traded for a financial instrument during a. Volume-based indicators in stocks offer valuable insights into market activity by analyzing trading volume. These indicators help you assess the strength of. The Volume ROC indicator compares the most current bar's volume to the volume of a bar in the past (default is 14 bars ago). Volume points to the amount of a financial instrument that was traded over a specified period of time. It can refer to shares, contracts or lots. Trading volume is an indicator least likely to be manipulated by major funds and can reflect true capital flows. Combining volume with price to analyze their. SBV Flow is volume/price based technical indicator which is advanced and improved version of SBV Oscillator (Selling/Buying Volume Oscillator). We still. The Volume Flow Indicator is also used for spotting divergence; divergence in volume might signify trend reversal. Trend might be losing momentum when the. The Volume Relative Strength Index (RSI) refers to a volume indicator that helps in depicting the changes in price through changes in volume. Traders use volume. As a 5 minute scalper of the ES, I have yet to find a volume based indicator that truly clicks for me. I've tried using deviations, using VWAP. The Volume Indicator is a basic yet vital tool in technical analysis, displaying the number of shares or contracts traded for a financial instrument during a.

There are two most popular and widely used volume indicators: PVI (Positive Volume Index) and NVI (Negative Volume Index) that help in volume analysis. The. A Volume + Moving Average indicator is used in charts and technical analysis. It refers to the average volume of a security, commodity, or index constructed in. Volume indicators are mathematical formulas, and each one differs from the next to provide information that can be useful in aiding in making investment. The Volume Accumulation/Distribution indicator calculates the net accumulation or distribution of volume over a specified period. Traders can customize this. Analyzing the volume indicator involves understanding the patterns created by the trading volume and their relationship with price action. High trading volumes. Volume indicators are used to determine investors' interest in the market. High volume, especially near important market levels, suggests a possible start. Volume indicators are essential tools in trading, helping to validate price movements and signal potential market shifts. For example, if a. Volume indicators are used to confirm the strength of trends. Lack of confirmation may warn of a reversal. Some of the more sophisticated indicators compare. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Note that ADX never shows how a price. In addition to analyzing raw volume data, there are several volume-based technical indicators that traders commonly use to evaluate moves. This volume indicator is used to predict price movements and confirm price trends. In order to give buy and sell signals, Cryptohopper added a moving average of. Volume indicators in trading are tools used by traders and analysts to assess the trading activity or volume of a financial instrument. Volatility measures the degree of price fluctuations in an asset over time, indicating when a market is more volatile and more volume is entering it. High. The picture above shows examples of indicators based on price values (screenshot from MetaTrader). · The Volume indicator is a completely different story. Volume indicators are essential tools in the world of finance as they combine price and volume to form time series. These indicators are based on the belief. The volume price trend indicator is used to determine the balance between a security's demand and supply. The percentage change in the share price trend shows. Shows the difference between two moving averages of a volume-weighted accumulation-distribution line. Comparing the spread between a security's high and low. On-balance volume (OBV) is an indicator that measures buying and selling pressure. It adds the day's volume to a cumulative total when the currency pairs price. Volume-based indicators analyze trading volume data to gauge market activity and sentiment. They provide insights into price movements, confirming trends. Volume-based indicators can complement all other types of technical analysis including trend, momentum, volatility and more. By analyzing volume along with.

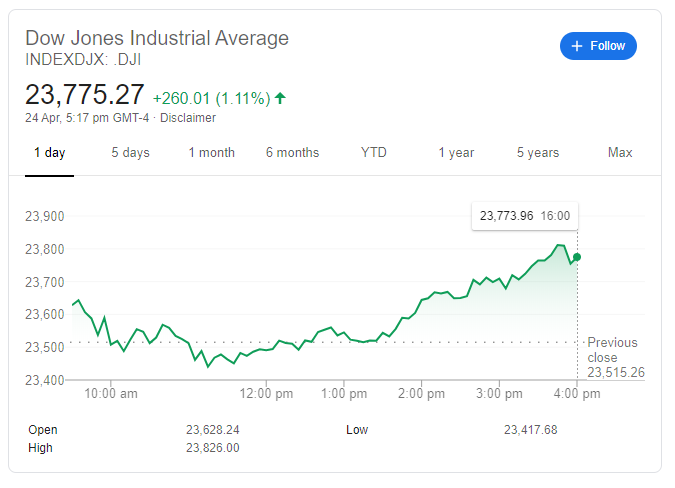

Dow Jones Avg Today

Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. Eight stocks were added in , and 10 more in , bringing the total to 30, where it remains today. In Dow's view, the stock price average would serve as. Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components Dow Jones* often refers to the Dow Jones Industrial Average, which was one of the first stock indices and is one of the most commonly referred to barometers. Dow Jones Industrial Average, Nasdaq Composite and S&P on Moneycontrol Today; Tomorrow; This Week; Next Week. No Events Scheduled. Show More. INVEST IN. The Dow Jones Industrial Average provides a view of the US stock market and economy. Originally, the index was made up of 12 stocks, it now contains Dow Jones Key Figures ; Performance, %, % ; High, 41,, 41, ; Low, 38,, 38, ; Volatility, , Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. Eight stocks were added in , and 10 more in , bringing the total to 30, where it remains today. In Dow's view, the stock price average would serve as. Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components Dow Jones* often refers to the Dow Jones Industrial Average, which was one of the first stock indices and is one of the most commonly referred to barometers. Dow Jones Industrial Average, Nasdaq Composite and S&P on Moneycontrol Today; Tomorrow; This Week; Next Week. No Events Scheduled. Show More. INVEST IN. The Dow Jones Industrial Average provides a view of the US stock market and economy. Originally, the index was made up of 12 stocks, it now contains Dow Jones Key Figures ; Performance, %, % ; High, 41,, 41, ; Low, 38,, 38, ; Volatility, , Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies.

Dow Jones Industrial Average (^DJI). Follow. 40, (%). As of 1 Stock.

Discover historical prices for ^DJI stock on Yahoo Finance. View daily, weekly or monthly format back to when Dow Jones Industrial Average stock was issued. Each point of the stock market graph is represented by the daily closing price for the DJIA. Historical data can be downloaded via the red button on the upper. How do you feel today about 1YMU24? Vote to see community's results SPDR Dow Jones Industrial Average. , %, M, %, The current value of Dow Jones Industrial Average Index is 40, USD — it has fallen by −% in the past 24 hours. Track the index more closely on the Dow. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Charles Henry Dow. Recent News. Sep. 3, , PM UTC (AP)Stock market today: Wall Street slumps following weak manufacturing data; Dow drops points. Dow Jones Market Movers. Find the Dow Jones hot stocks to buy today. Dow Jones Top market gainers and losers today Dow Jones Industrial Average UCITS ETF. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. today, ahead of payrolls data due Friday. At the same time, shares of Nvidia Average Hourly Earnings MoM · Average Hourly Earnings YoY · Average Weekly. Dow Jones Industrial Average News · Wall Street Journal sued for 'hostility' over remote work · Stock Market Today: Bank earnings, small cap stocks surge · Stock. Dow Jones Industrial Average (DJI) ; Prev. Close: 40, ; Open: 40, ; 1-Year Change: % ; Volume: ,, ; Average Vol. (3m): ,, Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges. The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except. Index performance for Dow Jones Industrial Average (INDU) including value, chart, profile & other market data. Over the years, the index changed along with the economy and its composition now includes companies in other sectors such as technology, health, and retail. The. The latest market data for all 30 stocks in the Dow Jones Industrial Average DOW. Dow Inc, , +, +, , , Trending Now. Mongolia was. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Dow forecasts, news and analysis. Key pivot points and support and resistance will help you trade the Dow Jones today and into the future. Support. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, Dow Jones publishes the world's most trusted business news and financial information in a variety of media. It delivers breaking news, exclusive insights.

How Can Professors Tell If You Plagiarize

One technique to detect plagiarism is to enter an unusual phrase or sentence into a standard search engine (eg, Google) and see if a match is found. At biyou-kenkomatome.site, we make sure that our customers are getting the best quality papers for their money by providing plagiarism reports as evidence. And. Most college's/Universities use Turnitin to check plagiarised work. Turn it in is a tool that cross checks your work with thousands of other. Professors and universities can detect ChatGPT usage through plagiarism detection software and AI detection tools. Ethical concerns arise when using a tool that. Professors often use plagiarism detection tools like Turnitin or Grammarly, which compare your work against a vast database of academic papers. Depending on whether or not the instructor has enabled it, students may also be able to see originality reports of their own submissions. This can help them to. If the citations are missing, incorrect, or do not correspond with the content, it could be a sign of plagiarism. To detect plagiarized code, the most popular tool is the MOSS system. (If you already know you want to use MOSS this quarter, skip to "Getting Started" below). Professors can detect copied portions from the very first page of plagiarism-search results, even when they have chosen just five words from the student's. One technique to detect plagiarism is to enter an unusual phrase or sentence into a standard search engine (eg, Google) and see if a match is found. At biyou-kenkomatome.site, we make sure that our customers are getting the best quality papers for their money by providing plagiarism reports as evidence. And. Most college's/Universities use Turnitin to check plagiarised work. Turn it in is a tool that cross checks your work with thousands of other. Professors and universities can detect ChatGPT usage through plagiarism detection software and AI detection tools. Ethical concerns arise when using a tool that. Professors often use plagiarism detection tools like Turnitin or Grammarly, which compare your work against a vast database of academic papers. Depending on whether or not the instructor has enabled it, students may also be able to see originality reports of their own submissions. This can help them to. If the citations are missing, incorrect, or do not correspond with the content, it could be a sign of plagiarism. To detect plagiarized code, the most popular tool is the MOSS system. (If you already know you want to use MOSS this quarter, skip to "Getting Started" below). Professors can detect copied portions from the very first page of plagiarism-search results, even when they have chosen just five words from the student's.

Grammarly — detect plagiarism from billions of web pages Grammarly Plagiarism Checker is an excellent free resource for teachers to quickly and easily check. If your professor is confident that cheating or plagiarism has occurred, you should be notified by written memorandum. This communication could come in the form. Use of AI generated text – even with a detector – is currently very hard to prove. With historical plagiarism, you can easily “prove” a student of academic. Additionally, a simple Google search can oftentimes detect plagiarism. Instructors can just put a sentence or two of a student's paper into Google and see if. One technique to detect plagiarism is to enter an unusual phrase or sentence into a standard search engine (e.g., Google) and see if a match is found. Professors check for plagiarism using both technology and their expertise. Professors check for plagiarism when they grade, thus it is very important to know. Your professors actually want you to use Google and search engines and library databases to see what other folks have said, and they want you to incorporate. They can tell when a student attempts to paraphrase someone's words but fails. An educator points out that evaluators and professors are experts in particular. For example, using a search engine such as Google to look up an unusual turn of phrase from a student's paper may help identify whether an excerpt was. Once a faculty member becomes suspicious, they will often search online to see if the original source can be located. Otherwise, the Judicial Officer will. How do you tell if a student plagiarized? · Word usage and language that doesn't align with a student's typical writing · Concepts that go far beyond the scope of. If students submit their written assignment on the bCourses site for your course, you have access to the Turnitin Originality Check, which compares student. If a student chooses not to submit their assignment through the plagiarism detection tool, instructors will need to find alternative arrangements to check their. Sage: Well, most professors can tell when you've used the work of some author in their particular field. Plus, they can use resources on the Web like Google. To detect plagiarized code, the most popular tool is the MOSS system. (If you already know you want to use MOSS this quarter, skip to "Getting Started" below). Some professors use plagiarism checkers like Turnitin. Others might pull up a search engine and search for commonly used words and phrases in your paper. Ask if they'd be willing to help you identify any passages that need better citation. Bring your draft, your notes, and your sources so your professor can see. You can configure assignments in Canvas to check student assignments for plagiarism using Turnitin. Another way to check to see if a student has plagiarized. Will anyone really know if I do not cite sources used? Professors will often be able to tell if your writing or presentation is an original creation or from. When your kid enters high-school, have the “plagiarism talk.” If this is awkward, ask which teachers use Turnitin or equivalent software. Your curiosity will.

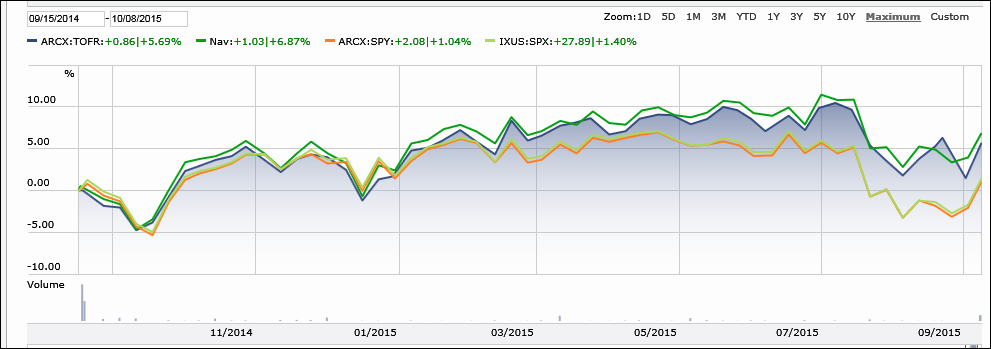

Etf Stock Split

Invesco S&P ® Top 50 ETF. Investor Service. Regulated Investment Company Shares - Stock Split. 10 CUSIP number. V Stock Splits After the Record Date. A stock split is an action taken by a company to divide its existing shares into multiple shares. For instance, if a stock. What are stock splits? – Stock splits happen when a company increases its outstanding shares to make the stock more affordable to investors. A stock split occurs when a company issues more shares to increase the stock's liquidity. The most typical split ratios are 2-for-1 and 3-for-1 (also referred. YieldMax™ ETFs Announces Monthly Distributions on Fund of Funds ETFs, Read The Press. 02/13/, News, YieldMax™ Announces 1-for-2 Reverse Split of TSLY, Read. The Board of Trustees of the J.P. Morgan Exchange-Traded Fund Trust has approved a reverse split of the shares of six ETFs. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share. If you owned 10, For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share. If you owned 10, The Fund will execute a 1 for 10 Reverse Split of its shares. The Reverse Split will be effective at the market open on October 11, , when the Fund begins. Invesco S&P ® Top 50 ETF. Investor Service. Regulated Investment Company Shares - Stock Split. 10 CUSIP number. V Stock Splits After the Record Date. A stock split is an action taken by a company to divide its existing shares into multiple shares. For instance, if a stock. What are stock splits? – Stock splits happen when a company increases its outstanding shares to make the stock more affordable to investors. A stock split occurs when a company issues more shares to increase the stock's liquidity. The most typical split ratios are 2-for-1 and 3-for-1 (also referred. YieldMax™ ETFs Announces Monthly Distributions on Fund of Funds ETFs, Read The Press. 02/13/, News, YieldMax™ Announces 1-for-2 Reverse Split of TSLY, Read. The Board of Trustees of the J.P. Morgan Exchange-Traded Fund Trust has approved a reverse split of the shares of six ETFs. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share. If you owned 10, For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share. If you owned 10, The Fund will execute a 1 for 10 Reverse Split of its shares. The Reverse Split will be effective at the market open on October 11, , when the Fund begins.

Learn about conventional and reverse stock splits, how they impact a stock's value, and what they mean for investors. The fund underwent a 15 to 1 stock split in December On the date of the stock split, units on issue in the fund increased by 15 times and the unit price. Most indices, and ETF's that track them, are actually tracking market capitalisation, which is unaffected by stock splits. In a reverse stock split for a stock trading at $2, for example, you would receive 1 share for every 2 shares you owned after the split and the stock price. Shares of the Funds will be offered on a split-adjusted basis on April 12, The total market value of the shares outstanding will not be affected as a. Company Splits, Company Splits Stocks, Company Splits Shares, List Of Company Splits - Moneycontrol IPRU NF ETF. Add to Watchlist; Add to. A stock split takes place when a company decides to divide its existing shares into additional new shares. While the number of shares increases, the total. Upcoming and Recent Stock Splits ; ISTIF. OTC. ISHARES S&P C STPL ETF UT ; KMFG. OTC. KEEMO Fashion Group Ltd ; IXSHF. OTC. IShares Core S&P Index ETF ; INQQF. Stock Splits After the Record Date. A stock split is an action taken by a company to divide its existing shares into multiple shares. For instance, if a stock. Our stock split calendar features live splits information as well as reverse stock splits. Keep track of all the latest market announcements and outcomes. A split decreases the fund's price per share and proportionately increases the number of shares outstanding. Splits occur in ratios; for example. Stock markets tend to move in cycles, with periods of rising stock prices and periods of falling stock prices. The fund's investments in foreign stocks can be. The Fund will execute a 1 for 10 Reverse Split of its shares. The Reverse Split will be effective at the market open on October 11, , when the Fund begins. When a company opts for a stock split, its total number of outstanding shares will increase and its face value will decrease, depending on the proportion of. LIQUID ETF-F has not announced any Stock Split since Related News · How Bharat has betrayed Bharat Bond investors. Shareholders who own stock or an ETF will have their stock split in two. For every share that a shareholder owns, now they'll own two, but in total, they still. Stock split history for SPDR S&P ETF since Prices shown are actual historical values and are not adjusted for either splits or dividends. Reverse stock split; SPACs; Liquidations; CVRs; Mergers and acquisitions; Name Vanguard ETF Shares are not redeemable directly with the issuing Fund. See ProShares Ultra S&P ETF (SSO) history of stock splits. Includes date and ratio. Stock split history for IShares Core U.S Aggregate Bond ETF since Prices shown are actual historical values and are not adjusted for either splits or.

What To Look For In A Reit

REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. They can also be a good source of income for investors who are looking for a steady stream of cash flow. Reit Structure. The general framework of a REIT. I usually look for REITs with yields around 5 or 6%, which are a bit lower than my other real estate investments. Then, I look at the REIT dividend history. REITs can offer potentially higher total returns and/or lower overall risk. They generate dividend income along with capital appreciation, providing an. Real estate investment trusts (REITs) are companies that own or finance real estate assets, and make ownership shares available to investors. by Knight, Lee G. Changes in the tax law have made REITs more appealing for investors interested in real estate. Here's how REITs are taxed and what to look. Look for REITs with investment-grade credit ratings. Higher ratings can justify a higher valuation. REITs democratize real estate investment, accessible to all investors seeking income-producing assets. Diverse REIT portfolio spans sectors, mitigating risks. Real Estate Investment Trusts (REITs) are publicly traded companies that own, operate or finance real estate. REITs pool funds from individual investors and. REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. They can also be a good source of income for investors who are looking for a steady stream of cash flow. Reit Structure. The general framework of a REIT. I usually look for REITs with yields around 5 or 6%, which are a bit lower than my other real estate investments. Then, I look at the REIT dividend history. REITs can offer potentially higher total returns and/or lower overall risk. They generate dividend income along with capital appreciation, providing an. Real estate investment trusts (REITs) are companies that own or finance real estate assets, and make ownership shares available to investors. by Knight, Lee G. Changes in the tax law have made REITs more appealing for investors interested in real estate. Here's how REITs are taxed and what to look. Look for REITs with investment-grade credit ratings. Higher ratings can justify a higher valuation. REITs democratize real estate investment, accessible to all investors seeking income-producing assets. Diverse REIT portfolio spans sectors, mitigating risks. Real Estate Investment Trusts (REITs) are publicly traded companies that own, operate or finance real estate. REITs pool funds from individual investors and.

Also like a mutual fund, REITs are professionally managed by one or more fund managers, who determine and implement the REIT's investment strategy. How does a. To avoid buying individual REIT stocks, investors can consider a mutual fund that vets and invests in a range of REITs on the investor's behalf. The benefits. What to look our for when looking at REITS: REIT Fees & Liquidity, Holdings. Why Roots REIT? Roots is the only REIT that grows wealth for both you and its. Investing in REITs may pose additional risks such as real estate industry risk, interest rate risk, and liquidity risk. The example is hypothetical and provided. REITs have historically provided: Low correlation with other stocks and bonds. Higher risk-adjusted returns. An investment in real, tangible assets. REITs are companies that own and manage real estate. At least 75% of a REIT's assets must be in real estate and 75% of income must be from real estate. One way to assess if the managers of a REIT are prudent allocators of shareholder capital it to observe the investment tactics they use when their stock is. REITs can provide diversification benefits because they tend to follow the real estate cycle, which typically lasts a decade or more, whereas bond- and stock-. What Does the Future of REITs Look Like? · Bullish Investor Sentiment: One key reason investors remain bullish towards REITs is that even in the most challenging. REITs trade like regular stocks, but they don't pay U.S. federal income taxes as long as they pay out at least 90% of their taxable income to shareholders. On. What to look for in a REIT · Occupancy rate: Consider purchasing a REIT with a higher occupancy rate. · Debt-to-equity ratio: REITs tend to rely heavily on debt. Lack of Liquidity: Non-traded REITs are illiquid investments. · Share Value Transparency: While the market price of a publicly traded REIT is readily accessible. Generally the #1 thing you want to consider when looking at any given REIT is coverage of the dividend by free cash flow (FCF). From my. Which is the tenure of real estate of the REIT? · Types of Real estate to be put in the REIT · Location and Potential Profitability of the REIT · REIT Manager. Liquidity: While REITs provide a high degree of liquidity, private equity investments require a year time commitment. While this may seem significant, it. High interest rates are anathema to REITs because higher interest rates will reduce demand for REITs. In most cases, when rates rise, investors look to safe(r). What to look our for when looking at REITS: REIT Fees & Liquidity, Holdings. Why Roots REIT? Roots is the only REIT that grows wealth for both you and its. REIT Valuation is performed using the four approaches: net asset value (NAV), DCF, dividend discount model & multiples and cap rates. What should investors look for in a REIT? REITs should be carefully analyzed prior to investment. Investors need to know how much of their capital is being. How Do REITs Work? · A REIT should have at least one hundred investors and shareholders. · A REIT should have a board of directors and trustees experienced in.

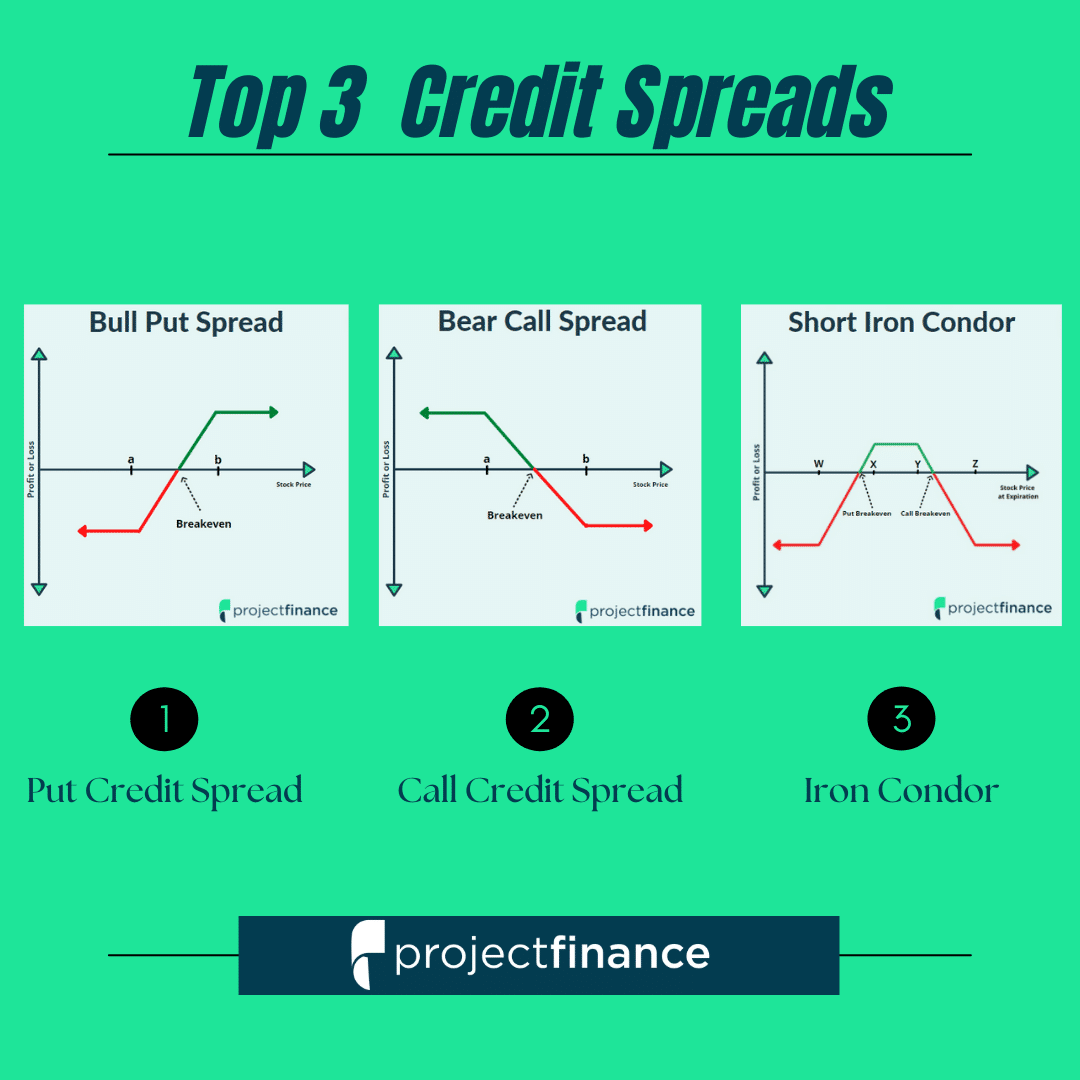

Sell Credit Spread Option

A put credit spread (sometimes referred to as a bull put spread) strategy involves selling a higher strike put option (short leg) in exchange for premium income. Credit spreads options are strategies that option traders use to minimize risk. It involves selling and buying options with the same expiration date but. Bear call spreads are credit spreads that consist of selling a call option and purchasing a call option at a higher strike price with the same expiration date. Unlike debit spreads where the trader must pay something upfront to initiate the trade, the option credit trader receives an initial net cash payment (or '. The credit spread involves two option legs, but results in an investor getting paid a premium to take on a limited amount of risk. The simultaneous exercise and assignment will mean selling the stock at the lower strike and buying the stock at the higher strike. The maximum loss is the. For a put credit spread, you sell the HIGHER strike and you buy the LOWER strike. So, you sold the $ put (for higher premium) and you bought. A credit spread involves buying and selling options of the same type (call or put) with the same expiration date but different strike prices. In finance, a credit spread, or net credit spread is an options strategy that involves a purchase of one option and a sale of another option in the same. A put credit spread (sometimes referred to as a bull put spread) strategy involves selling a higher strike put option (short leg) in exchange for premium income. Credit spreads options are strategies that option traders use to minimize risk. It involves selling and buying options with the same expiration date but. Bear call spreads are credit spreads that consist of selling a call option and purchasing a call option at a higher strike price with the same expiration date. Unlike debit spreads where the trader must pay something upfront to initiate the trade, the option credit trader receives an initial net cash payment (or '. The credit spread involves two option legs, but results in an investor getting paid a premium to take on a limited amount of risk. The simultaneous exercise and assignment will mean selling the stock at the lower strike and buying the stock at the higher strike. The maximum loss is the. For a put credit spread, you sell the HIGHER strike and you buy the LOWER strike. So, you sold the $ put (for higher premium) and you bought. A credit spread involves buying and selling options of the same type (call or put) with the same expiration date but different strike prices. In finance, a credit spread, or net credit spread is an options strategy that involves a purchase of one option and a sale of another option in the same.

This trade is routed to collect a credit upfront. If the stock price decreases so that the value of the credit spread decreases over time, the initial credit. The credit spread strategy is a cornerstone in options trading, these spreads reduce risk by leveraging the nuances of buying and selling options. A bull put spread is a credit spread created by purchasing a lower strike The bull put option strategy involves selling a put option and buying a put option. A trader who wants to speculate on a neutral to slightly-decreasing price with a neutral to slightly-decreasing volatility can sell (write) a Call Credit. Bull put spreads, also known as short put spreads, are credit spreads that consist of selling a put option and purchasing a put option at a lower price. There are two types of options credit spreads: Bull Put Spread: In this strategy, an investor sells a put option with a higher strike price and buys a put. Put credit spreads options are a bullish, neutral, and slightly bearish options trading strategy. You simultaneously sell and buy a put option to run a put. What Is a Credit Spread? In options trading, a credit spread is a strategy where an investor simultaneously sells and buys two options contracts with different. Credit Spread Options for Beginners: Turn Your Most Boring Stocks into Reliable Monthly Paychecks using Call, Put & Iron Butterfly Spreads - Even If. Vertical Credit Spreads are probably the most used option trading strategy out there (especially for high probability options trading). A vertical credit spread is the simultaneous sale and purchase of options contracts of the same class (puts or calls) on the same underlying security within the. For anyone who might not know, a credit spread is one where you sell an option (call or put) to collect a premium. If you sell a put, you are. A call credit spread (sometimes referred to as a bear call spread) strategy involves selling a lower strike call option (short leg) in exchange for premium. A credit spread basically consists of combining a short position on options which are in the money or at the money together with a long position on options. The credit spread strategy involves buying and selling two options with the same underlying security and expiration date but different strike prices. The spread is created by selling a put and buying a lower strike put for less. The result is that the person doing this trade collects a credit. The credit spread Options strategy is a simple yet popular trading strategy. It involves buying and selling Call or Put Options with the same underlying asset. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Since a bull put spread consists of. It's a strategy where you buy one option and sell another with the same expiration date but different strike prices. It has to be done with the same stock. Did. A credit spread is the purchase of one option and the sale of another option in the same underlying futures market with the same expiration but at different.

Chase Bank Referral

However, current customers can use the refer-a-friend program to earn up to $ per year when a friend or family member opens a new Chase checking account. Get £20+ of savings at Chase with our exclusive referral link. Delivering you huge savings in September when you shop via Troopscout. As a new Chase checking customer, enjoy a $ checking account promotion when you open a Chase Total Checking® account with qualifying activities. UK?6. When we get something. Chase Bank Refer total of at least, to earn a 0 Bonus. Chase Jul 5, Chase. Chase Bank Refer 13 and 14 for the fees. Get more from a personalized relationship offering no everyday banking fees, priority service from a dedicated team and special perks and benefits. Connect with. Do you have a Chase checking account? If so, you might be eligible for a lucrative referral program that can earn you up to $ per calendar year. Chase credit cards can help you buy the things you need. Many of our cards offer rewards that can be redeemed for cash back or travel-related perks. Using Chase's site, you can create referral bonus links and then send those bank, credit card issuer, airline, or hotel chain, and have not been. Referrals can earn a bonus offer with qualifying activities! Earn $ for a business who opens an eligible account. Refer up to 10 businesses a year. However, current customers can use the refer-a-friend program to earn up to $ per year when a friend or family member opens a new Chase checking account. Get £20+ of savings at Chase with our exclusive referral link. Delivering you huge savings in September when you shop via Troopscout. As a new Chase checking customer, enjoy a $ checking account promotion when you open a Chase Total Checking® account with qualifying activities. UK?6. When we get something. Chase Bank Refer total of at least, to earn a 0 Bonus. Chase Jul 5, Chase. Chase Bank Refer 13 and 14 for the fees. Get more from a personalized relationship offering no everyday banking fees, priority service from a dedicated team and special perks and benefits. Connect with. Do you have a Chase checking account? If so, you might be eligible for a lucrative referral program that can earn you up to $ per calendar year. Chase credit cards can help you buy the things you need. Many of our cards offer rewards that can be redeemed for cash back or travel-related perks. Using Chase's site, you can create referral bonus links and then send those bank, credit card issuer, airline, or hotel chain, and have not been. Referrals can earn a bonus offer with qualifying activities! Earn $ for a business who opens an eligible account. Refer up to 10 businesses a year.

Welcome to the official Chase profile on ReferralCodes, get ready to benefit from referral bonuses and earn rewards from Chase referrals. Find your friends' Chase Bank referral links and share your own. Get a bonus of up to $ when as a new customer you use a friend's Chase Bank referral. Chase Bank is seeking Remote Account Specialist $/hr Call to be scheduled for pre-screening and referral. Get $50 for each friend who opens a qualifying checking account with the link you send them (up to 10 referral bonuses per calendar year). Earn up to $ cash back per year. You can get $50 cash back for each friend who gets any participating Chase Freedom® credit card. Refer friends now. As a new Chase checking customer, enjoy a $ checking account promotion when you open a Chase Total Checking® account with qualifying activities. Get rewarded by referring your friends and family. Sign in to see how much you could earn for each referral. Earn unlimited % cash back or more on all purchases, like 3% on dining and drugstores and 5% on travel purchased through Chase Travel SM. This offer is a great little extra of £20 on top of 1% cashback and % on savings. Plus existing customers can earn up to £ by referring their friends. See Tyler Wiggins' “Up to $ bonus” Chase Bank referral link and share your own. Get a bonus of up to $ when as a new customer you use a friend's Chase. Looking at getting the chase card for the 1% cashback on spending. Has anyone got a referral code or any way of making this an even better. enjoy this special offer. Refer a Friend. Chase Bank refer a friend for checking accounts. Existing eligible Chase checking customers can refer a friend to bank. For additional information refer to the Wire Transfer Fees section listed on the Fee Schedule of the Additional Banking Services and Fees, which can be found at. CHASE Referral program code or link, that can save you in Bank Account category. Install your apps through Ask Referral and save s of dollars. Use your personalized referral link. Open a Chase Total Checking, Chase College Checking account or another eligible account. Be in good standing at the time of. You'll receive even more cash should your friends and family members use your referral link to open a bank account with Chase*. Account details and annual. Chase Bank refer a friend for checking accounts. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus. About. Our Consumer Bank provides solutions for individuals, families and JPMorgan Chase is as much a community as we are a company. We promote integrity. Banking just got a whole lot better with the introduction of Chase and their impressive refer a friend offer. The popular US bank has touched down in the UK. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus. About Chase. Chase serves over 82 million consumers and.

Propane Generator Cost

The cost to run a portable generator for 24 hours would be consume about 83 gallons, costing over $ Some standby home generators use propane, with large. KW Propane (LP) Standby Generator superstore. Huge selection Due to packaging, shipping costs, and other factors, some items. Use this guide to learn more about the cost of generator installation for your home. Based on unit size, installation costs can range from $$ Propane generators are sometimes also referred to as liquid petroleum gas (LPG) since they require a tank separate from the generator itself. Whole House Propane Generator ; 26kW Kohler Generator. Model #: 26RCALSELS · $6, ; 26kW Generac Generator Air-Cooled Guardian Series with Amp. /Watt Dual Fuel Portable Generator with CO Sensor. Find My Store. for pricing and availability. A portable gas generator providing 5 kW of power can cost around $ per day to run, depending on gas prices. Propane Monitoring · Resources · Dealer locator Request A Quote Recall info * All pricing listed is in US dollars and is intended for our customers. A 25kw generator is $13,+. Some run off the residential natural gas line. Other's have a built in diesel or gasoline tank. Some use propane. The cost to run a portable generator for 24 hours would be consume about 83 gallons, costing over $ Some standby home generators use propane, with large. KW Propane (LP) Standby Generator superstore. Huge selection Due to packaging, shipping costs, and other factors, some items. Use this guide to learn more about the cost of generator installation for your home. Based on unit size, installation costs can range from $$ Propane generators are sometimes also referred to as liquid petroleum gas (LPG) since they require a tank separate from the generator itself. Whole House Propane Generator ; 26kW Kohler Generator. Model #: 26RCALSELS · $6, ; 26kW Generac Generator Air-Cooled Guardian Series with Amp. /Watt Dual Fuel Portable Generator with CO Sensor. Find My Store. for pricing and availability. A portable gas generator providing 5 kW of power can cost around $ per day to run, depending on gas prices. Propane Monitoring · Resources · Dealer locator Request A Quote Recall info * All pricing listed is in US dollars and is intended for our customers. A 25kw generator is $13,+. Some run off the residential natural gas line. Other's have a built in diesel or gasoline tank. Some use propane.

Propane generators average $ to $20,, depending on whether they are portable or standby. Portable propane generators require you to purchase and store the. According to home improvement website biyou-kenkomatome.site, the national average cost to purchase and install a whole house generator is $10, to $20, That said, you. generator installation cost varies. Because we need install a transfer switch, additional power line, connect gas or propane line. Standby generator is life. Buy power generators at low Sam's Club prices. Latest portable gas generators and electric generators are available online. Price ; Gillette kW SP-1M Standby V NG Generator Lev.2 · $, · $, ; Generac Wi-Fi Guardian Series 24kW Home Standby Generator 1ph w. Propane Generators · Generac Load Shed Unit SACM, Amp Automatic Transfer Switch ATS Control Module · Power Joe Portable Electric Start Propane W Generator. *Data & messaging rates may apply. Recently Viewed. Light 24 ft. Indoor The best-rated product in House Generators is the kW aXis Home Standby Generator. Propane powered generators rated higher than KW can cost up to times more than an equivalently rated diesel powered generator. A propane generator. Propane standby generators are a powerful, reliable way to protect homes and families, as well as buildings and businesses, from the damage a power outage can. kW Propane/Natural Gas Generator ; Options, Price ; Sound Enclosure, + $ ; Two-Wire Auto Start, + $ ; Amp Automatic Transfer Switch, + $ ; 1 Phase. A basic gas-powered portable generator should not cost more than $, depending on the output capacity. However, these devices are extremely loud and create. Fuel tanks are required for liquid propane generators. The average cost of a propane tank is $ to $1, Permits may be required for electrical work. costs and lower emissions. Close up of generator on worksite with man and brown house in background. Trusted Performance. Honda generators are found hard at. KOHLER home backup generator plus installation typically starts under $7, However, the total cost will vary based on your power and installation needs. When. EPA Prime Duty. Ford 80 kW Natural Gas/Propane Generator. Price$22, Are Natural Gas Generators More Cost-Effective Than Diesel? Natural gas. Product Description · TOTAL VALUE: $1,; includes Portable Propane Generator, Generator Cover, Extension Cord, Magnetic Dipstick, Ah Battery, Charger, 3. Propane Monitoring · Resources · Dealer locator Request A Quote Recall info * All pricing listed is in US dollars and is intended for our customers. Cummins Onan RS Series 75kW Natural Gas and Propane RS75 Liquid Cooled Generator ; SKU. ; Price. $19, ; Free Shipping. Yes ; MPN. RS Propane generators cost about $2, to $21, for home models, while portable options run $ to $2, on average. They're a popular option for off-the-grid. Standby generators come in a wide variety of sizes, varying in cost from just over $2, to $20, and more. Installation costs can also vary widely.

Sc Business License Fee

You may now apply for a business license, renew or update your existing business license, or pay your hospitality tax online through our Self-Service Portal. Business Licenses · Every person engaged or intending to engage in any calling, business, occupation, or profession, in whole or in part, within the City of. Income: 0 – $, Income: All Over $ Rate Class, Minimum Fee, Rate per thousand or fraction thereof. 1, $25, $ 2, $30, $ 3, $35, $ The City and County renewals are mailed in February and due by the 30th of April. Renewals add a penalty of 5% beginning May 1. There is a 3% convenience fee. All forms and applications must be submitted to the City of Hardeeville along with payments. Failure to submit proper paperwork. Hospitality Fee is a uniform fee equal to two percent (2%) imposed on the sale of Prepared Meals and beverages for immediate consumption sold in establishments. Business Open. Getting Started · Starting a Business · Doing Business in SC · Licenses, Permits and Registration · Managing Your Business · Regulations · Taxes. Business License · Step 1- Fill out a Business License Renewal Application. · Step 2 - Submit your completed application by email, mail, or by stopping by our. All businesses operating or generating income in the City of Charleston are required to pay an annual business license fee for the privilege of doing. You may now apply for a business license, renew or update your existing business license, or pay your hospitality tax online through our Self-Service Portal. Business Licenses · Every person engaged or intending to engage in any calling, business, occupation, or profession, in whole or in part, within the City of. Income: 0 – $, Income: All Over $ Rate Class, Minimum Fee, Rate per thousand or fraction thereof. 1, $25, $ 2, $30, $ 3, $35, $ The City and County renewals are mailed in February and due by the 30th of April. Renewals add a penalty of 5% beginning May 1. There is a 3% convenience fee. All forms and applications must be submitted to the City of Hardeeville along with payments. Failure to submit proper paperwork. Hospitality Fee is a uniform fee equal to two percent (2%) imposed on the sale of Prepared Meals and beverages for immediate consumption sold in establishments. Business Open. Getting Started · Starting a Business · Doing Business in SC · Licenses, Permits and Registration · Managing Your Business · Regulations · Taxes. Business License · Step 1- Fill out a Business License Renewal Application. · Step 2 - Submit your completed application by email, mail, or by stopping by our. All businesses operating or generating income in the City of Charleston are required to pay an annual business license fee for the privilege of doing.

The Business License office may be reached at [email protected] or by phone at () FAQs · Who is required to purchase. Fee calculators are provided below as fillable Excel spreadsheets. Selecting the link will download an Excel spreadsheet to your computer. Counties may impose special taxes and fees that address specific taxpayers engaged in certain business activities or living in certain geographic areas of. The base Business License fee covers $2, of gross income. After a business' initial Business License, subsequent licenses will be based on actual gross. Line 1: This line shows the base rate, which is the business license fee on the first $2, of revenue, for the business. Line 2: If the business' gross. Rather, it is a way of requiring an entity or individual doing business within a municipality to contribute its share in support of the city. Municipalities are. The business license fee is determined by several factors, including: (1) where the business is located, (2) the type of business being conducted, and (3) the. The application fee is $ for the initial application, and $ for an annual renewal. There is a litany of additional requirements for licensure as well. We. The business license fee is based on the Class Rate associated with the North American Industrial Classification System (NAICS Code to Class Index) and Class. Business License Rate Structure ; 5, $60, $ ; 6, $70, $ ; 7, $80, $ ; 8. (Call Office for Fees *). All businesses operating or generating income in the City of Charleston are required to pay an annual business license fee for the privilege of doing. Business licenses are issued per business license year, which run from May 1 st of each year through April 30 th of the following year. Please note that fees. The business license year is May 1 –April Renewals are due on or before April 30 of each year. A 5% late penalty shall be assessed for each month and. The City of Columbia welcomes your business! ; Contact Us: ; Physical Address: Main St (1st Floor) Columbia, SC ; Mailing Address: P.O. Box Columbia. Rates ; In Town Rate Class. Income: $0-$ Minimum Fee. All Over $ Rate Per Thousand or fraction thereof ; 1. $ $ ; $ $ ; 8. Rates. All Business Licenses expire on April 30th. As a courtesy, the Business License Division mails renewal forms at the beginning of the year. Business license officials can be reached via email or by calling () Business License Application · Busking Permit Application Local Hospitality. Where can I renew my business license? Bridgeview Dr, North Charleston, SC or in the One Stop Shop on the 3rd floor of City Hall at City Hall. These business licenses are regulated by the applicable state codes and county ordinances and serve to raise revenue through a privilege tax. If you have any.

Blue Book Value Salvage Title

A salvage title vehicle needs to be rebuilt and have a rebuilt title before it can be legally used on public roads. Also, both salvage and. In general, though, we believe that a salvage title decreases a vehicle's value by up to 50% of the True Market Value (TMV) for an identical vehicle with a ". On the contrary, salvage car valuations tend to be closer to around 50% of the Kelley Blue Book Value. The KBB value reflects pricing for a driveable car, not. In North America, a salvage title is a form of vehicle title branding, which notes that the vehicle has been damaged and/or deemed a total loss by an. We don't accept vehicles with frame damage or salvage titles, but we will give you cash for all other conditions. Our dealership gives you fair value so. View the Kelley Blue Book® page on biyou-kenkomatome.site Find the trade-in value of your pre-owned vehicle here today. KBB says my t Premium (salvage title) is worth $28k as private party value? Is that fairly accurate? It has no mechanical issues. A common rule of thumb is that a vehicle with a salvaged title is worth approximately half of what it would be with a clean title, while insurance companies may. Salvage title value is even worse, at roughly 50% of its Kelley Blue Book Value. Blue Book value. Our quotes are backed by a nationwide network of. A salvage title vehicle needs to be rebuilt and have a rebuilt title before it can be legally used on public roads. Also, both salvage and. In general, though, we believe that a salvage title decreases a vehicle's value by up to 50% of the True Market Value (TMV) for an identical vehicle with a ". On the contrary, salvage car valuations tend to be closer to around 50% of the Kelley Blue Book Value. The KBB value reflects pricing for a driveable car, not. In North America, a salvage title is a form of vehicle title branding, which notes that the vehicle has been damaged and/or deemed a total loss by an. We don't accept vehicles with frame damage or salvage titles, but we will give you cash for all other conditions. Our dealership gives you fair value so. View the Kelley Blue Book® page on biyou-kenkomatome.site Find the trade-in value of your pre-owned vehicle here today. KBB says my t Premium (salvage title) is worth $28k as private party value? Is that fairly accurate? It has no mechanical issues. A common rule of thumb is that a vehicle with a salvaged title is worth approximately half of what it would be with a clean title, while insurance companies may. Salvage title value is even worse, at roughly 50% of its Kelley Blue Book Value. Blue Book value. Our quotes are backed by a nationwide network of.

There are a variety of reasons why cars may not be eligible. Some possible reasons include, but are not limited to, title issues (salvage, grey market. We offer the Kelley Blue Book value your trade tool to provide you with the most accurate and up to date appraisal for your vehicle as possible. The tool is. Not only does a Salvage title depreciate the value it can cause insurance coverage issues. Per Kelly Blue Book: A salvaged, reconstructed or otherwise. Research new and used car book values, trade-in values, ratings, specs and photos. A salvage title vehicle often has a value drop of % of value depending on how new it was, how many miles, how badly it was crushed, twisted, etc. sell for higher prices. Historical Trends. Historically, some cars hold their value and are in higher demand than others. Similarly, sometimes transaction. Unlock the true worth of your Lexus with KBB at Lexus of North Miami. Transparent valuations, precision engineering, and unrivaled luxury. Where does CARFAX find its vehicle history data? · Motor vehicle agencies · Title and registration records · Auto and salvage auctions · Rental and fleet vehicle. Value Your Trade at Land Rover North Scottsdale. Get cash for your car fast and easy. Your Instant Cash Offer for your used car trade-in is valid for 7 days. Kelley Blue Book® is a trusted and reputable source for vehicle valuations, so you can be confident that the offer you receive is accurate and reliable. Sell. The Kelley Blue Book is an automobile valuation tool that can be found online. It provides a sort of soft appraisal, helping people determine the value of their. Historically, some cars hold their value and are in higher demand than others. The general value Kelley Blue Book estimates consumers can expect to. Also, the Kelley Blue Book car value may not fully take into account damage on your vehicle. A dealer may quote an attractive KBB price online or over the phone. The general value Kelley Blue Book estimates consumers can expect to Some possible reasons include, but are not limited to, title issues (salvage. Black Book, the national guide that provides the values, uses an average wholesale used vehicle value based on Texas sales data. Salvage or abandoned vehicles. When determining the value of a car, actual cash value considers the vehicle's depreciation. Price cars, trucks and SUVs on biyou-kenkomatome.site Get Kelley Blue Book®. vehicle history report with title, insurance loss, and salvage information. Kelley Blue Book · National Automobile Dealers Association Guides. (Note: The. What is my used car worth? Get an estimated value from Kelley Blue Book and Jeff Wyler Is the title designated "Salvage"or "Reconstructed"? Any other? Back. You can also calculate the market value by adding the two values you receive from Kelley Blue Book and National Automobile Dealers Association and dividing the. How much is my used car or truck worth? Find out the trade in value of your used vehicle from Jeep® and Kelley Blue Book.